Intra-company Standards for Financial Statement Analysis:

Intracompany standards for financial statement analysis are. Full PDF Package Download Full PDF.

The Common Size Analysis Of Financial Statements

A COMPARATIVE STUDY ON FINANCIAL STATEMENT ANALYSIS OF CIPLA LIMITED.

. Often based on a companys prior performance. It is only a means to reach conclusions. Guidelines are developed from.

D Are based on a companys prior performance. Intra-company standards for financial statements analysis. When it comes down to it this analysis objective is to basically assess the companys financial statements by assigning certain percent from the base amount to each item of financial statements.

Not a Substitute of Judgement. The measurement of key relations among financial statement items is known as. Perform a vertical analysis of a companys financial statements.

Based on Past Data. E Are set by competitors. This basis compares an item or financial.

Are set by the financial performance and condition of the companys industry. Limitations of financial statement analysis. B Are based on a companys prior performance and on rules of thumb.

Comparative financial statements in which each individual financial statement amount is expressed as a percentage of a base amount are called. Submitted in partial fulfillment of the requirements for qualifying Master of Business Administration FINANCE By Utpal Rakshit. Are often set by competitors.

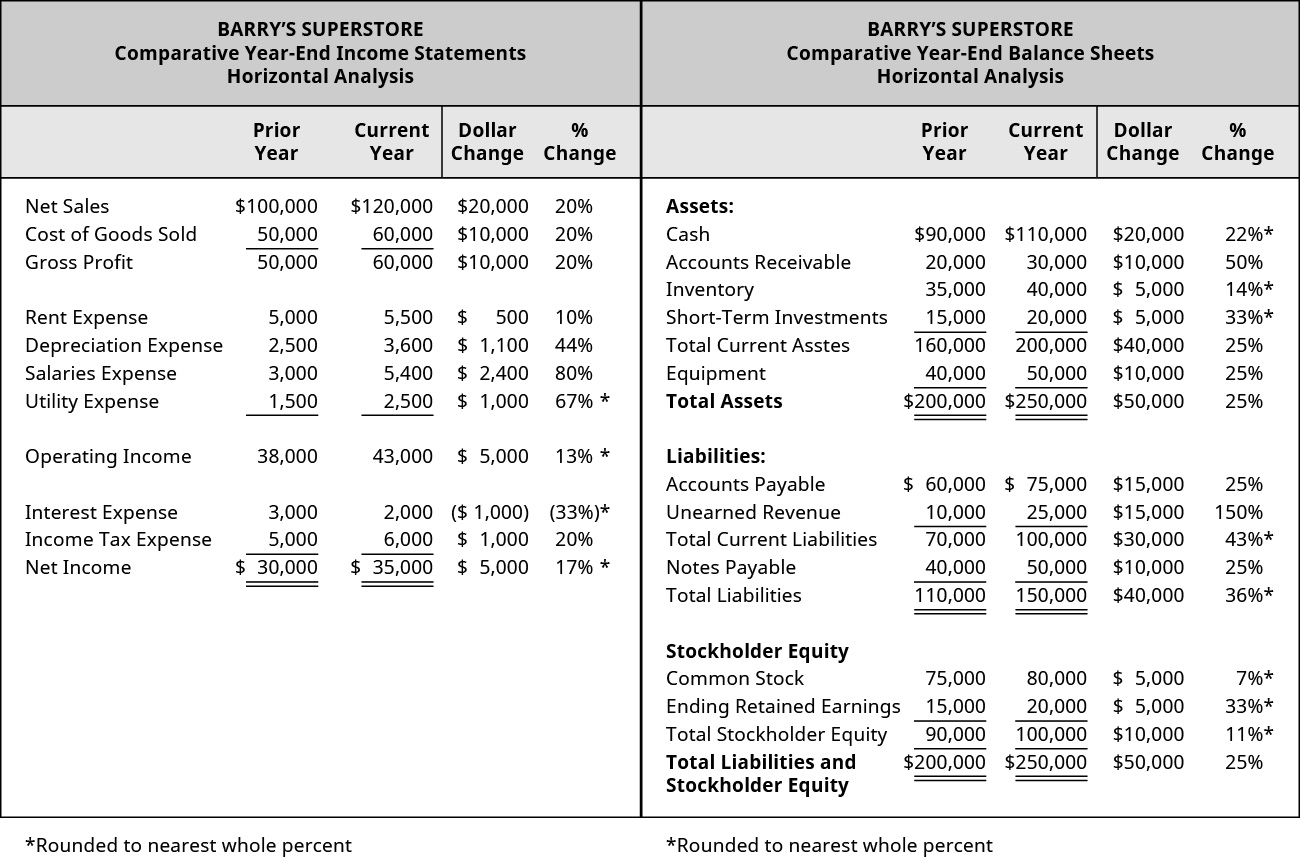

Compares an itemfinancial relationship within an entity in the current year with the same itemrelationship in one or more prior years. We know that the analysis of financial statement helps the analyst to know the financial information from the financial data contained in the financial statements and to assess the financial health ie. Financial statement analysis involves all of the following except.

Are based on rules of thumb. Are set by the companys industry. Flag question O c.

Ratio analysis is a process used to analyze an organizations financial statements to assess its financial status. You just studied 12 terms. Learn about the standards for comparison in.

This type of evaluation is often used for inter-and intra-company needs according to Weygandt Kimmel Kieso 2008. A corportation reported cash of 14000 and total assets of 178300 on its balance sheet. Are based on a companys prior performance and relations between its financial items.

Vertical analysis can be used to compare and identify trends within a company from year to year intracompany or between different companies intercompany. Are often based on a companys prior performance. An analysis of financial statement cannot take place of sound judgement.

Not yet answered O a. To provide useful information to mgt Procedure of Financial Statement Analysis The following procedure is adopted for the analysis and interpretation of financial statements- The analyst should acquaint himself with principles and postulated of accounting. Terms in this set 25 Intra-company standards for financial statement analysis.

152 Intracompany standards for financial statement analysis. Intracompany standards for financial statement analysis. Intracompany standards for financial statement analysisAre often based on a companys prior performanceAre often set by competitorsAre set by the companys industryAre based on rules of thumbAre published in Dun and Bradstreet.

A vertical analysis of financial statements often reports the percentage of each line item to a total amount. Intracompany standards for financial statement analysis Multiple Choice Are set by the companys industry Are based on rules of thumb Are set by competitors Are based on a companys prior performance and on rules of thumb. The task involves interpretation of ratio values by examining the behavior of a firms financials over a period.

Marked out of 100 O b. Compare a companys cash balance at the end of current year with last years balance to find the amount of the increasedecrease. Ultimately the judgements are taken by an interested party or analyst on his her intelligence and skill.

Intra-company standards for financial statement analysis. 152 A Are set by the companys industry. Intra-firm ratio analysis is the comparison of ratios of a particular firm over a period.

Are often based on a companys prior performance. BCO123 - Accounting II Question 4 Intracompany standards for financial statement analysis. C Are based on rules of thumb.

Now up your study game with Learn mode. Interacompany standard for financial analysis are based on a companys prior performance and relation bet View the full answer Transcribed image text. Trend Analysis is another name for intra-firm ratio analysis.

Are based on a companys prior performance relations between its financial items. Objectives of Analysis of Financial Statement 3. Financial reporting financial statement analysis and valuation.

Financial Statement Analysis Need for comparative analysis 1. Need of Analysis of Financial Statement. Hence it is dynamic in nature.

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)

International Accounting Standards Ias

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment